Contact us for more information on our classroom training options

Firms that require a higher-level, more in-depth training experience can book classroom training and workshops with us. These sessions are hosted by our expert compliance experts and can be provided in person or over a teams/zoom call depending on your preference.

All sessions are bespoke and can cover any areas of compliance, regulation, or FCA requirement that you are interested in. Developed by our experts, our training courses offer a fresh, expert perspective on all topics and can be tailored to meet your needs. We have hosted classroom training on a wide range of topics relevant to our clients and their individual staff needs. Some of our most popular courses include;

- Consumer Duty

- AML/CTF

- GDPR

- Payment services/PSD2

- SMCR conduct rules

- Culture and ethics

- and board briefings that help firms consider their risk and compliance planning and strategies based on the FCA's most recent business plan and key areas of focus

If you are interested in finding out whether we could support you with face-to-face compliance training, contact us to discuss your options with one of our experts.

Submit an enquiry

For a broader look at the types of training we offer, visit our online training page where we have listed all of our core online courses by sector and topic.

The sectors we work with...

-

Investment Firms

Our Investment Firms team use their experienced regulatory knowledge to help asset managers and broker dealers with a full service offering over a large spectrum of regulatory issues.

READ MORE -

Consumer Finance & Insurance

We have successfully managed over 800 FCA applications for credit firms and currently have over 350 credit clients benefitting from our ongoing support.

READ MORE -

Digital Finance

Our industry leading team know the regulatory landscape inside out, with our experience extending from traditional and challenger banks, authorised e-money and payment institutions through to fintechs and cryptoassets.

READ MORE -

Financial Resilience

Our specialist Financial Resilience Team can help firms interpret their prudential requirements and avoid common errors that are likely to lead to unwanted attention from the regulator.

READ MORE -

Financial Crime

Cosegic’s experienced Financial Crime Team can help a broad range of firms across multiple different sectors, with a special emphasis on those organisations for whom financial crime is especially complex and demanding.

READ MORE

Online training

Looking for an online training solution?

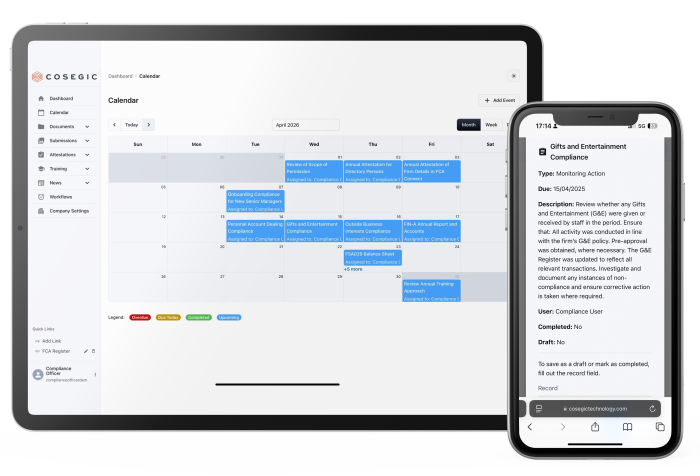

Our market-leading online system has over 5,000 active users and 40 courses written by subject matter experts. We work hard to ensure that the training courses we provide are up-to-date and relevant to the topics they cover. Our compliance software platform Cosegic Portal provides access to Cosegic’s e-learning materials and learning management system (‘LMS’). The LMS is a powerful tool that allows: the allocation of compliance training to employees at the appropriate level (support staff vs front office staff); tracks which employees have completed their training, whether they passed the course, and flags employees who have not met training deadlines. Find out more about our online training courses by clicking the link below.

You might be interested in these services...

-

Ongoing Compliance

Whether you’re seeking a compliance partner for the first time, or want to benchmark your current provider we offer a genuinely fresh perspective.

Find out more -

Training

E-learning, classroom training and board briefings to help firms meet FCA training and competence obligations.

Find out more -

FCA Authorisation

If you want to provide regulated financial services, we can help you avoid pitfalls and delays with your FCA authorisation application.

Find out more